The statistics are alarming. According to the ATO, over 70% of Australian property investors own just one property. Only a tiny fraction—less than 1%—ever reach the portfolio size of 6+ properties needed for true financial freedom.

Why?

You don't lack ambition. You lack the right Game Plan.

Click the button to create your Financial Freedom Strategy

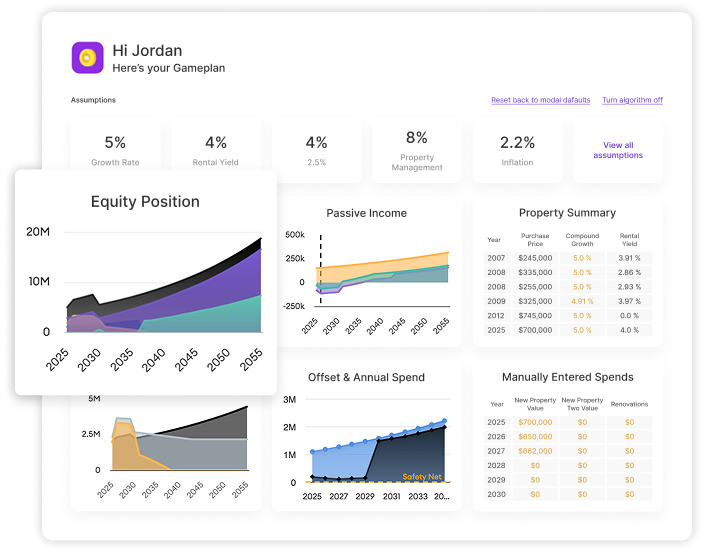

It is a custom property investment tool that allows you to reverse-engineer your dream retirement and shows you the exact steps to get there.

Whether you want to replace your salary, retire early, or build generational wealth, our technology bridges the gap between where you are

now and the top 1% of investors.

And you can gain access to it today at no cost - Test before you invest!

A visual, interactive timeline that maps out your entire investment journey from today until retirement.

Advanced algorithms that calculate your borrowing power and equity position in real-time.

Compare multiple strategies side-by-side. What if interest rates rise? What if I buy a commercial property instead of residential? What if I

renovate?

Sleep soundly knowing your portfolio can survive market fluctuations.

Input your end goal (e.g., "$200,000 passive income by age 50") and the tool works backward to tell you what you need to buy and when.

Built on live market data and proven investment formulas.